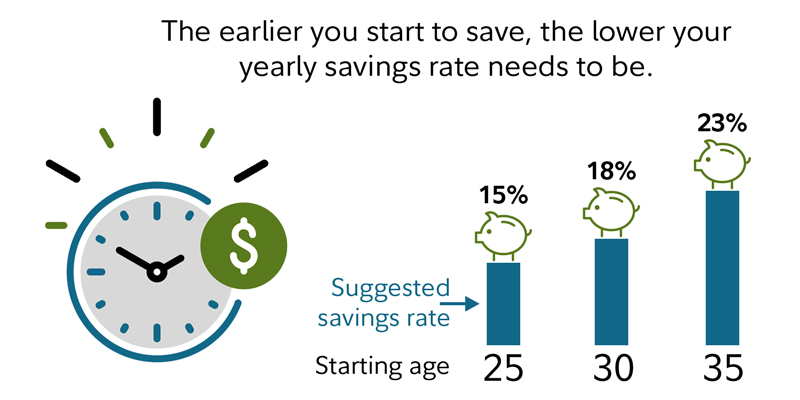

When it comes to securing your financial future, investing in retirement is one of the most proactive steps you can take. If you are wondering when is the best time to start saving for retirement, the answer is simple: now. According to a recent report from CNN Money, saving for retirement in your 20s is the ideal time to start.

Some of the advantages of saving for your retirement early include:

Interest that compounds

Flexibility in your later years

Ensures you have enough money to last your retirement years

You may be ready to begin saving for retirement but have no clue where to start. The good news is that there are solid and actionable steps that you can take as an individual to start saving for retirement and ensure your financial well-being well into old age.

Picturing Retirement: Goal Setting and Budgeting

Retirement takes careful planning. One of the first steps that you can take to invest in your retirement is to sit down and figure out your retirement goals. You will need to carefully reflect and decide what you want your retirement lifestyle to look like. A few questions to ask yourself are:

How often do I want to travel?

What passions and hobbies would I like to pursue?

Where would I like to live, and do I want to move?

How is my health? Will I be comfortable moving into assisted living, or should I set aside funds for in-home care?

Do I have debt that I need to eliminate or accommodate such as mortgages, HELOCs or title loans?

Do I want to invest in accounts for my children and grandchildren?

Depending on your responses to these questions, this will impact just how aggressively you want to save. Once you know what you want to save for, you can begin to set realistic financial goals. In addition to mapping out what you would like to save for, you will need to also factor in the cost of living and necessary expenses. Some of these recurring mandatory costs include housing, healthcare, and transportation. Keep in mind, due to inflation, these costs are also likely to increase over time.

Retirement Accounts

Once you have a solid plan, you can begin to research and potentially invest in some retirement accounts. There are a variety of different accounts that you can invest in, and each comes with its own set of rules, advantages, disadvantages, and tax implications. In the early stages of your research, you may want to explore the following accounts:

401(k) Plan: This type of retirement account is usually offered through your employer. A huge advantage to this account type is that you can contribute a portion of your paycheck before taxes that go into a retirement account. As an added bonus, many employers offer 401(k) matching. This means that your employer will even contribute a certain amount towards your 401k. However, make sure you read the fine print here, as oftentimes you will need to be employed by that company for a certain amount of time.

403(b) Plan: 403(b)s are designed for a specific type of employee. Typically self-employed individuals or teachers in education explore this type of retirement account. These individuals usually have a pension that they get from their employer, but they want to contribute to an additional account as well. One potential disadvantage of a 403(b) is the somewhat high fees and hefty price you will pay for early withdrawal.

IRA Account: An IRA or Individual Retirement Arrangement, is an investment account designed to help you save for retirement. This is essentially a form of pension that provides huge tax advantages. This type of account essentially holds the investment of the contributor’s income in an account that grows either tax-free or tax-deferred.

Roth IRA Account: The main difference between an IRA and a Roth IRA is that Roth IRAs are contributed to with after-tax dollars, and your money can then grow tax-free.

457 Plan: If you are a government employee, you may want to explore a 457 Plan. While this type of account is similar to a 401(k) in the sense that they are both tax-advantaged plans, 457 plans are offered through local and state governments and through some nonprofits.

While all of these accounts have their own eligibility requirements, various tax implications and a variety of advantages and disadvantages, only you can decide what is the best account for you.

Depending on your retirement goals, you may also want to seek professional advice and work with a financial planner. A financial planner can help you set up these accounts as well as give you advice on different investments and which path will be the best for you to pursue.

Additional Steps You Can Take to Invest in Your Future

In addition to setting up a retirement account, there are other steps that you can take to invest in your future financial well-being and financial future. Some additional steps to consider include:

Diversify investments

Update your budget and invest regularly

Minimize fees

Don’t let summer travel cost you retirement(Opens in a new browser tab)

A diversified portfolio is a well managed portfolio. To diversify your financial portfolio means to quite literally “spread the wealth” of your investments across different types of investments. Different types of investments include: real estate, stocks, bonds and cash. By researching and figuring out what you want to invest in, and assessing your risk tolerance you can find ways to move your money around in a manner that works for you.

An additional item on your to-do list should be to update your budget and invest regularly. You will have different amounts of money to invest when you are paying for a child’s college education versus a time when your children are financially independent. Constantly assessing where you are at in your budget and financial timeline will help you to best allocate your money.

Ensuring that you read the fine print of your investments is key. Education is powerful, and by educating yourself on fees, terms, and limitations, you will ensure that your money is safe and working for you. For example, a 403(b) is a solid investment account, but the early withdrawal fees can be staggering. Ensure you read the fine print!

Overall, educating yourself is one of the most proactive and empowering steps that you can take towards investing in your future. Through education, you pave the road toward financial success and overall well-being.